Inflation. Can anyone remember what that looks like? We have been living with historically ultra-low inflation for what seems like forever. We must go back to 1980 to see anything like what is currently being experienced in the US with the highest inflation in 40 years. And the UK not far behind with the highest inflation since 1990.

Inflation. Can anyone remember what that looks like? We have been living with historically ultra-low inflation for what seems like forever. We must go back to 1980 to see anything like what is currently being experienced in the US with the highest inflation in 40 years. And the UK not far behind with the highest inflation since 1990.

Today (12 April 2022), the Financial Times reported that US inflation has hit 8.5% with the UK at 7% and gaining.

While agreeing charge out rates that will remain in force for several years is less of a problem when inflation is low, few remember the bad old days when inflation really did take a chunk out of your buying power over time.

Many partners and business development professionals in law firms may never have been involved in a panel appointment that involved any kind of inflation adjustment through the period of appointment. Indeed, any attempt to include provisions to this effect would normally be laughed out of the room by procurement.

And even those that do contain such review provisions, we know from anecdotal experience are sometime not activated as the perceived cost/benefit (additional revenue versus client reaction) isn’t worth it.

It is unfortunately however time to dust off that argument and take a firmer line. If not, your margins on the work are going to deteriorate rapidly.

There is no reason of course for any client to agree to the inclusion of such provision, but if there is anything approximating a sense of fairness and supply chain continuity and quality, clients must be made to listen. In our experience, simply bleating about inflation is pointless. Rather, an evidence-based argument is the basis for a grown-up conversation that can work well.

Yes, compromise is almost inevitable but if you don’t even attempt the conversation, you have lost before you’ve even begun. It is worth also keeping in mind that while panel appointments may be for three years, it is very common practice for clients to persuade incumbents to hold their rates for up to another two years in return for which, “we won’t go out to the market again now”.

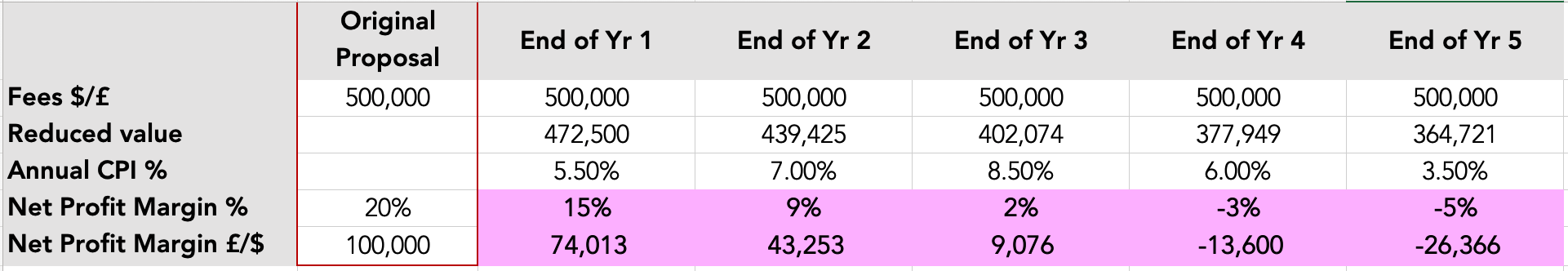

This has historically been a very effective client strategy and one which 95% of law firms accede to when put under pressure. Consider therefore what impact inflation might have on your margins over five years as illustrated by the following example.

Yes, time to dust off those long-since forgotten inflation adjustment clauses.